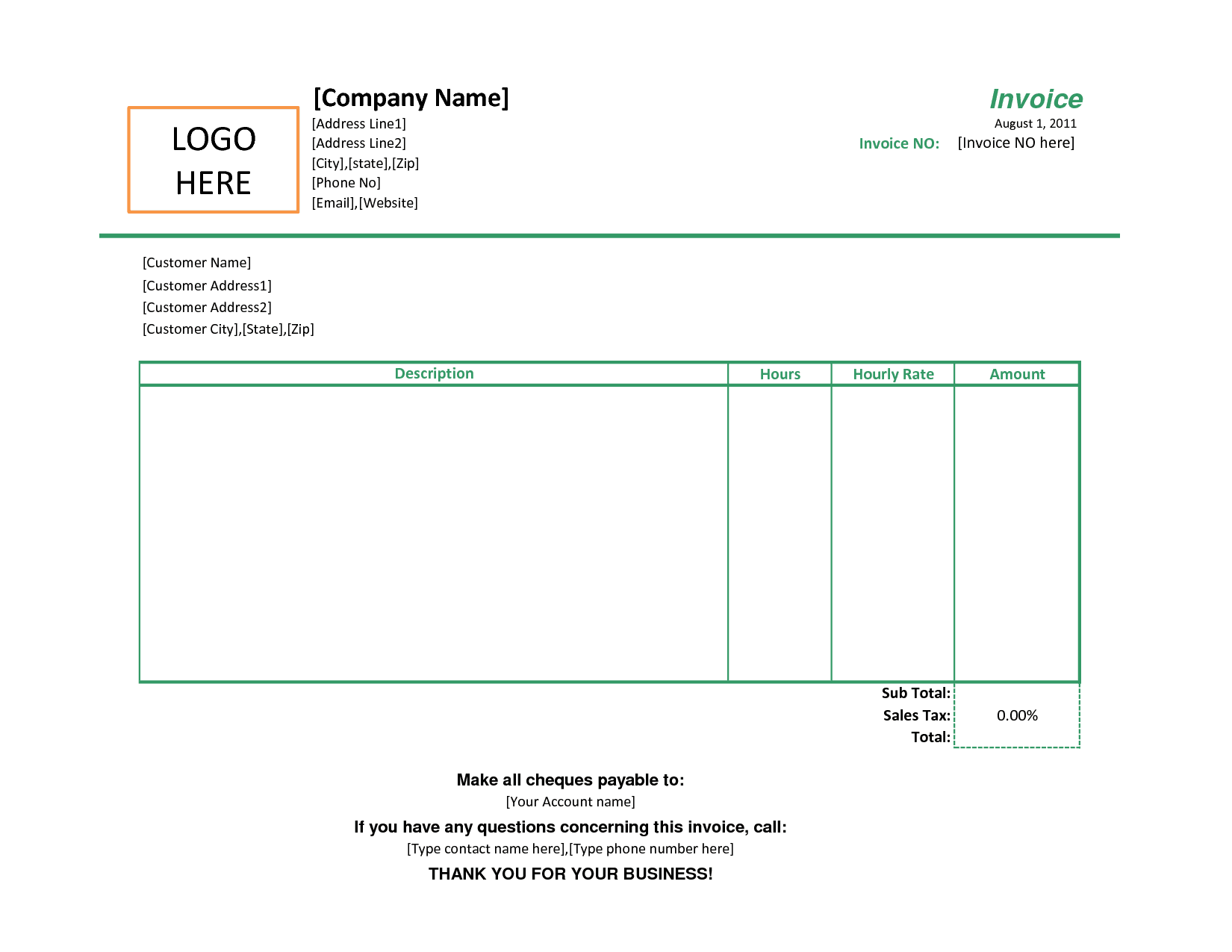

For example, you must state on the invoice that it's a 'tax invoice' and include the GST amount. You must include certain information to create a valid tax invoice for GST. Create and send invoices fast, easy, and for free. Free Invoice Template Save time and money by using one of over 100 free invoice designs. customer's purchase order (PO) number or contract agreement dates Basic Invoice Template Quickly customize an invoice with important details like your company name, address, line items, taxes, totals, and terms.name of the person who will pay the invoice (this can help speed up payment).name of the person who placed the order.customer's contact details such as postal address, email address and phone number.When invoicing a customer, it's standard practice to include the: direct banking details, including BSB and account number, account name, the name and branch of the bank and the reference number to be included in the transaction description.options, such as direct deposit, credit card, EFTPOS and cash.terms – for example, the number of days before payment is due, the final due date or a discount for early payment.goods and services tax (GST), if it applies.itemised description of goods and amount due.Customize and download them easily with the editor.

#INVOICES TEMPLATE CODE#

unique invoice number for your reference – it can help to add code to your invoices that identify the customer, date or job number Find out hundreds of business invoices templates ready to edit online, free and printable.Your invoice should reflect the product or service you've provided, the amount due and when. Information about the service and payment Australian business number (ABN) or Australian company name (ACN).email address, phone number and fax number.business name (and trading name, if you have one).

Your invoice should include information the customer needs to know to pay you on time – and details for your own bookkeeping.

0 kommentar(er)

0 kommentar(er)